For Chief Compliance Officers navigating today’s high-stakes regulatory environment, the numbers tell a sobering story. In 2024 alone, global anti-money laundering (AML) penalties surpassed $6 billion, with individual fines reaching $450 million against major financial institutions. The compliance landscape has become a minefield where traditional Enhanced Due Diligence (EDD) processes, reliant on manual reviews and fragmented systems, are failing to keep pace with sophisticated financial crime.

Enter the era of Agentic AI EDD, where intelligent systems don’t just assist compliance teams they transform entire due diligence workflows from reactive checklists to proactive risk intelligence engines.

The Compliance Cost Crisis: Why Traditional EDD Is Failing

The traditional EDD model is breaking under pressure. Consider these realities facing today’s compliance officers:

- Time drain: High-risk customer investigations consume 8-15 hours each

- False positive overload: Up to 95% of alerts prove to be false positives

- Regulatory lag: Manual processes create 60-90 day gaps in risk monitoring

- Staff burnout: Compliance teams spend 70% of their time on data collection versus analysis

A major European bank recently faced $275 million in penalties after regulators discovered their manual due diligence processes missed critical ownership connections across three jurisdictions. They’re not alone.

Agentic AI: Your 24/7 Digital Due Diligence Investigator

Unlike traditional automation, Agentic AI systems demonstrate autonomous reasoning and decision-making capabilities. In practice, this means:

Autonomous Entity Resolution: AI that maps complex corporate structures across 50+ jurisdictions in minutes, identifying ultimate beneficial owners (UBOs) that traditional methods miss. One institution discovered 22 previously unknown high-risk connections in their first month of AI implementation.

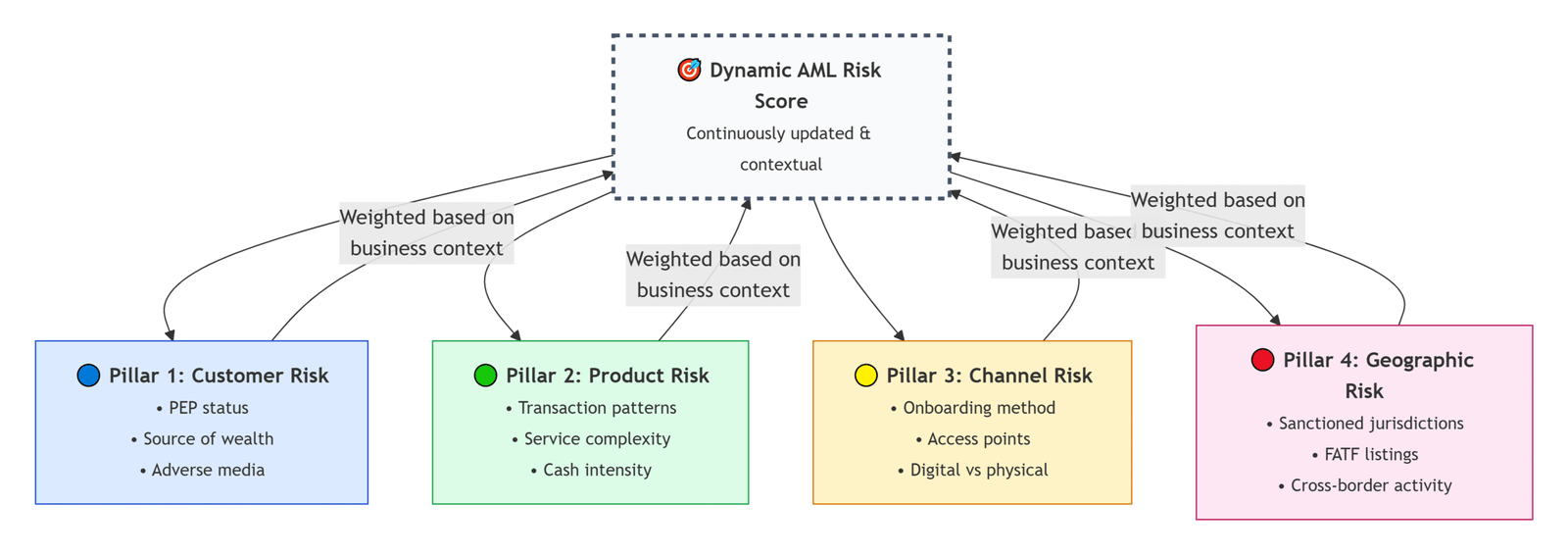

Continuous Risk Intelligence: Real-time monitoring that analyzes thousands of data points from geopolitical events to adverse media in 80+ languages adjusting risk scores dynamically rather than relying on quarterly reviews.

Predictive Risk Modeling: Machine learning algorithms that identify patterns preceding suspicious activity. A North American bank prevented a $32 million potential violation by detecting subtle transaction anomalies 45 days before traditional systems would have flagged the account.

AI-powered dashboards provide real-time risk intelligence and compliance metrics

The AI EDD Advantage: Quantifiable Results

Organizations implementing AI-driven EDD solutions report transformative outcomes:

Cost Efficiency: Reduction of 40-60% in due diligence operational costs, representing $3-5 million in annual savings for mid-sized banks.

Speed to Insight: High-risk case investigation time drops from weeks to hours, with 85% of standard cases resolved autonomously.

Accuracy Improvement: False positive rates decrease by 65-80%, while true positive detection increases by 40-55%.

Regulatory Confidence: Firms with mature AI EDD programs experience 90% fewer material findings during regulatory examinations.

Side-by-side comparison showing streamlined AI workflows versus traditional manual processes

IT Audit Automation: Closing the Technical Compliance Gap

For CCOs, the intersection of compliance and technology presents unique challenges. AI-driven IT audit automation delivers:

Continuous Control Monitoring: Real-time surveillance across thousands of systems, with automated evidence collection for regulatory requests. A financial services firm reduced SOX compliance preparation from 12 weeks to 3 weeks while improving coverage.

Predictive Audit Planning: Machine learning models that analyze control effectiveness and predict potential failures, shifting from calendar-based to risk-based auditing.

Automated Policy Enforcement: Systems that ensure configuration compliance across 100% of endpoints, eliminating manual verification gaps.

Implementation Roadmap: Starting Your AI EDD Journey

For compliance leaders ready to transform their due diligence function:

Phase 1: Strategic Assessment (Weeks 1-4)

- Conduct current-state analysis of EDD pain points

- Identify highest-impact use cases (PEP screening, complex entity resolution, etc.)

- Establish success metrics tied to regulatory outcomes

Phase 2: Pilot Program (Weeks 5-12)

- Deploy AI EDD for specific high-risk segments

- Focus on augmented intelligence—AI assisting human judgment

- Document ROI and regulatory acceptance

Phase 3: Scale & Integration (Months 4-9)

- Expand across customer lifecycle

- Integrate with existing GRC platforms

- Develop AI governance framework

Phase 4: Optimization (Ongoing)

- Continuous model refinement based on investigator feedback

- Expand to predictive analytics and autonomous decision support

- Establish AI ethics and bias monitoring protocols

Regulatory Considerations & Best Practices

Successful AI EDD implementation requires regulatory foresight:

Explainability First: Regulators increasingly demand transparency in AI decision-making. Ensure your systems provide clear audit trails and rationale for risk classifications.

Human Oversight: Maintain appropriate human-in-the-loop controls, particularly for high-risk decisions and model updates.

Data Governance: Implement robust data quality controls AI is only as good as its training data.

Continuous Validation: Regularly test AI systems against emerging typologies and regulatory expectations.

The Future Is Human + Machine Intelligence

The most effective compliance organizations aren’t replacing humans with machines, they’re creating powerful human-AI partnerships. AI handles the data-intensive, repetitive tasks: monitoring thousands of transactions, scanning global media sources, and mapping corporate structures. This frees compliance professionals to focus on strategic priorities: complex investigations, regulatory engagement, and risk-based decision making.

As regulatory expectations evolve toward continuous monitoring and predictive risk management, AI-enhanced due diligence transitions from a competitive advantage to a compliance necessity. The institutions that embrace this transformation today will define the compliance standards of tomorrow.

Your Next Step

Begin with a focused assessment: What are your greatest EDD pain points? Which regulatory findings keep recurring? What manual processes consume disproportionate resources?

The journey to AI-enhanced due diligence begins with a single use case but leads to a fundamentally stronger compliance posture, reduced regulatory risk, and significant operational efficiency.

Amra Technology specializes in AI-driven compliance solutions that transform enhanced due diligence from cost center to strategic asset. Our Agentic AI EDD platform helps financial institutions reduce compliance costs by 40-60% while significantly improving risk detection accuracy. Ready to transform your due diligence function? Schedule a personalized assessment.